It is no shocking thing that Covid-19 has had a grave impact on the oil markets. There has been a slump in demand and therefore, price.

Recently, Saudi Arabia wanted to support the oil prices by convincing the OPEC nations (and Russia) to cut back on Oil production. This seems like a sensible plan – deceasing supply to counter falling prices. This announcement took place in Vienna, the OPEC headquarters.

There was an expectation of cutting down the production but the scale of the cut back took everyone aback. Russia, an OPEC+ member, treated this as an unwelcomed announcement. Russia has its eyes set on the US Shale producers and felt that they would gain the most from this move.

Let’s understand the situation here in very simplified terms. The US has brought about Shale revolution which increased the global oil supply. The US produced more and more till it became world’s top producer. This forced the rivals, OPEC nations, to constantly cut back their production so that the oil prices stay stable at the higher end.

Now that you have a broad overview of the situation with US Shale producers, you are in a better position to appreciate Russia’s move. Russia declined to back Saudi Arabia’s proposal to reduce production and instead removed the restrictions and allowed its companies to produce as much oil as they wish to. Secondly, the Kremlin was also riled by US Sanctions on Nord Stream 2 (the proposed gas pipeline between Europe and Russia) and Rosneft’s trading arm recently.

This incident is a testament of Russia’s power and influence in the oil industry. As a direct consequence of Russia’s move, all oil producing nations removed restrictions on production and jumped into the price wars. Saudi Arabia is all set to kill two birds with one stone: squeeze both Russian and US Shale producers.

The fact that the oil production cost in Saudi Arabia is very low as compared to other nations twists the plot in favour of Saudi Arabia, despite the failure of Saudi-Russia oil deal. The main sufferers will be the US Shale producers, who already operate on wafer-thin margins and heavy financing.

Furthermore, Suadi has an upperhand in this situation because of the following:

1) Lower cost of oil extraction

2) Saudi has the most spare capacities globally and therefore, it can increase its output faster than its competitors.

3) Saudi’s 12m bpd capacity has been restored after the recent drone and missile strikes.

Anyone who looks at the momentum with which things are progressing will be obliged to state that Saudi Arabia is not in this for the short run. Saudi has made preparations for more oil productions and are selling oil at a humongous discount to gain marketshare.

The crown prince Mohammed bin Salman’s plan to grow the economy is dependent on the revenue from energy sector to fund the transformation. The adverse effects of this cut-throght price war have started to become explicitly visible. Shares of Saudi Aramco and the Saudi stock market have both taken a significant hit. However, the factors listed above will ensure that other countries bear a more severe brunt of the situation.

“At a time when shale producers face much tighter capital constraints to keep up output, a price war may push US oil companies already at risk of bankruptcy over the edge,” said Jason Bordoff, head of Columbia University’s Center for Global Energy Policy.

FT

I cannot help but recall the oil crash of 2014 which brought havoc in global financial markets and disrupted the government budgets of various countries.

How does Russia plan to support itself in this battle? Note that its cost of production is higher than Saudi Arabia, which means that the break even point for Russia will be a higher price and Suadi can sustain itself profitably even at lower prices. Russia has amassed a national wealth fund of $170bn and has alluded that it is willing to tap into the funds to offset any short term losses arising due to price war.

“The true result of the arrangement is that the total volume of oil that was reduced as a result of the repeated extension of the Opec+ agreement was completely and quickly replaced in the world market with American shale oil,” he said in a statement to state-owned news agency TASS.

FT

FINANCIAL MARKETS

The junk bonds, which have credit rating of BB or lower, are very high-yield securities. More than 11% of the junk bond market comprises of Energy companies.

The average US high-yield energy bond closed in “distressed” territory last week, defined as a cost of borrowing of 10 percentage points or more above Treasury yields.

FT

Even among the investment grade corporate bonds, Energy sector is amongst the ones with lowest ratings. Weaker oil prices may put more pressure on these companies and might create financing issues, which in the worst case scenario could lead a company to bankruptcy. To avoid the situation from going till bankruptcy, there could also be a wave of restructuring of this debt.

The real winners in this case will be the oil importing countries like China and India and companies with major raw material being oil.

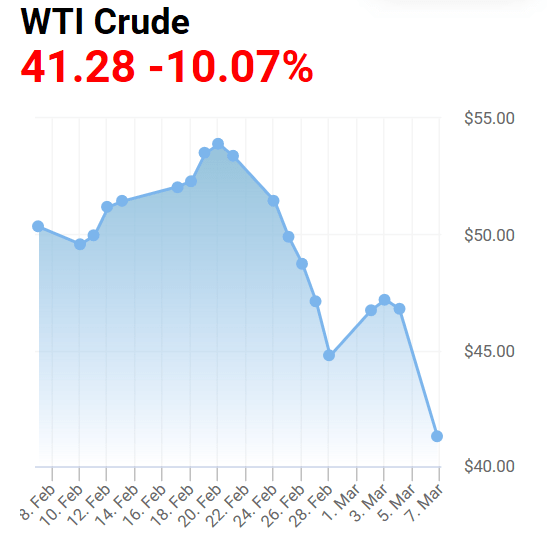

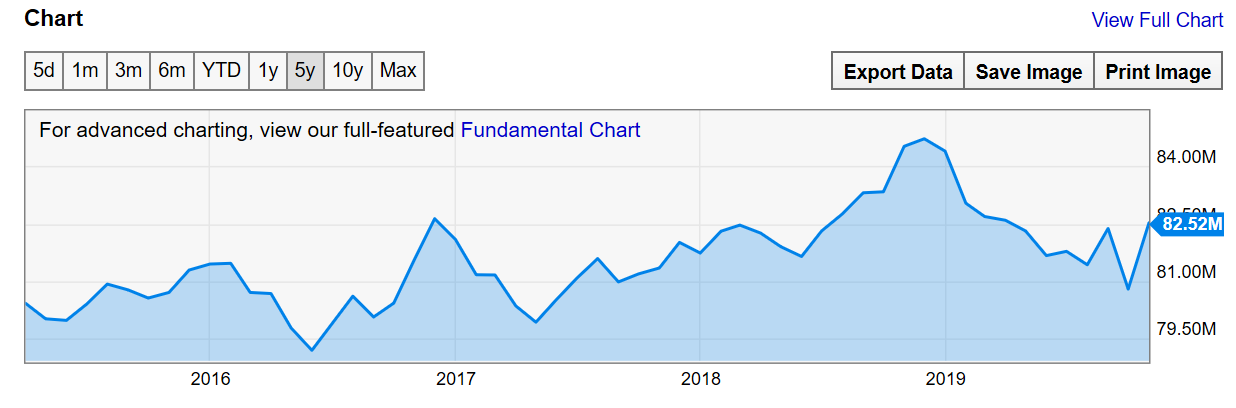

The first chart is WTI Crude Oil Prices and second is for the production of oil barrels per day: