- Amit Burman knows that, for a pilot, the toughest thing is to cede control. The fifth generation of the family that is the promoter of consumer products major Dabur has private pilot licence.

- It was in June 1996 that Burman decided to fly solo, when he launched fruit juice brand Real under Dabur Foods. The idea was to do something on his own, outside the family stable but without cutting the umbilical cord.

- With Dabur Foods being a wholly-owned subsidiary of Dabur, the young Burman got what he wanted — complete control. “I didn’t report to the CEO but to the directors who were family members,” recalls Burman, who is vice-chairman of Dabur India.

- In a decade, Dabur Foods crossed Rs 250 crore in revenue, the brand cornered over half of the market for juices. The talks of a demerger of the foods business and a stock market listing gained momentum.

- Professionalized a family business : Dabur, which was a family-run business till 1998, decided to merge the food business with the parent company. Consequently, Burman stepped down as CEO, ceded control of the Real brand and was appointed vice-chairman of Dabur. Burman (now chairman of Lite Bite Foods, which runs a chain of casual dining and quick service restaurants)

- Teething trouble

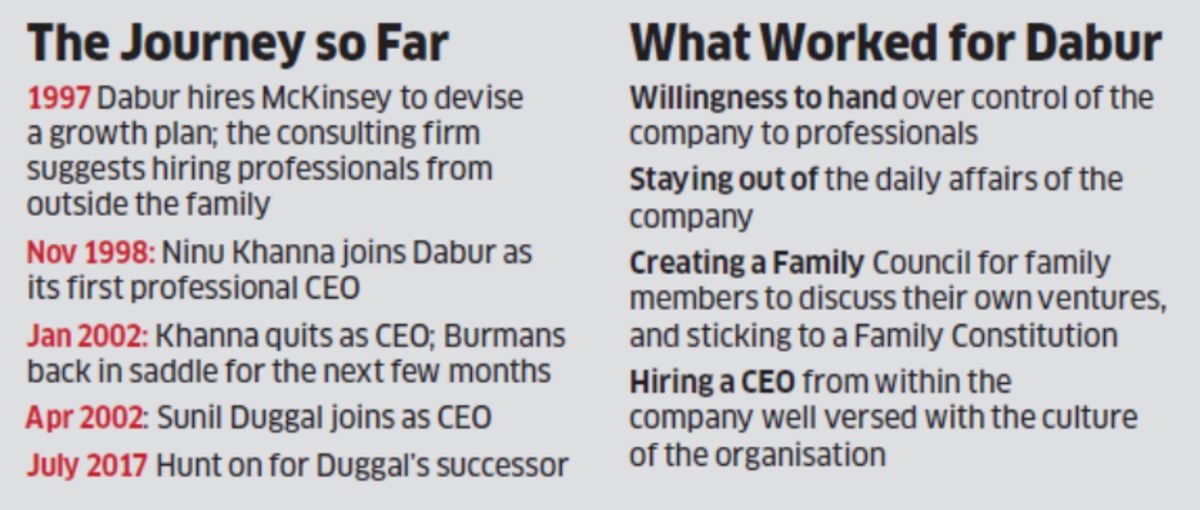

- In early 2002, its first professional CEO quit, reportedly over differences with family members.

- It was also during the same period—fiscal 2002—that Dabur reported a dip in profit after tax (PAT) as virtually stagnant sales of Rs 1,200 crore.

- Outsiders felt the audacious gambit of bringing in professionals had backfired.

- The family, however, went for a course correction and things have been smooth since then. Dabur was among the first families in India to separate ownership from management. Though it was a difficult decision, rapid growth over past two decades under a professional management validates it, he adds. From Rs 1,200 crore turnover in 2001-02 to Rs 7,680 crore five years later, Dabur has reaped rich dividends by the transformation. The family’s role, by now, had changed from hands-on intervention to being confined to ideation.

- “Today, we provide strategic direction and long-term vision to the company,” says chairman Burman. While the family does give suggestions to the professional team, the final decision on implementation rests with the management.

- “The period between 1999 and 2002 was perhaps the most turbulent in the company’s history,” says Duggal, who took over as CEO in April 2002. After resignation of the first professional chief executive, the family took control for over six months or so. Then it was up to Duggal to bring the situation back to normal. What helped the new CEO the most in winning the trust of the family was his familiarity with the culture of the company.

- Carving out a niche

It’s harder for an outsider to come into a family-run company.

- The outsider’s understanding of the family is low.

- Promoters’ confidence in the CEO’s capabilities is low.

- Cultural issues crop up during the initial phases of transition.

- the willingness of the family to embrace change and yet keep the family at the core is what stands out in the Dabur transition. They accepted that despite having qualified family members at senior positions, they needed to induct professionals to grow. That the family worked together to carve out a structure, which defined each member’s role and yet created an environment that respected all the members’ aspirations, is admirable.

- Another important ingredient for a successful transition to a professional-run company. While promoters need to have a big heart and courage to yield power, the professionals coming from outside too need to be sensitive to the cultural norms of the company. “It’s a two-way process. Both need to be accommodative and sensitive.”

Hi! I have checked your wordpress.com and i see you have a pretty good site here. Waiting for your next post… Keep blogging 😉

LikeLiked by 1 person

Wow didn’t know this before! Cool blog ..👍

LikeLiked by 1 person

Thanks for the brief summary here. Made my work easy

LikeLiked by 1 person

Wonderful article👏

LikeLiked by 1 person