Operating leverage is said to be present when a company becomes capable of increasing its revenue by increasing the volume of goods but the cost of producing it doesn’t increase or increases at a lower rate than revenue, thereby resulting in higher net profit margin. All in all, the increase in revenue is largely transferred to net profit as other expenses don’t increase proportionately (their change is less than change in revenue). In simple terms, either of the following can happen:-

a. Revenue per unit increases faster than cost per unit

b. Revenue per unit is stable while cost per unit decreases.

Remember, this is very different from “pricing power.” In pricing power, you are able to increase the price of your final product and people will still want to buy it. But operating leverage arises not due to increase in price of your final product but instead due to distribution of fixed cost among more number of units. But there is also no denying the fact that pricing power may help boost revenue, which can sometimes translate to operating leverage.

A very straight forward example is of a bakery. A bakery has certain fixed expenses (*don’t worry if you don’t know this as I’ll be explaining this later) like rent, electricity for running the machines and other appliances, depreciation for these machines, etc. It also has a few variable costs like water, dough, sugar, etc which depends upon the quantity of goods to be produced. Now, if the quantity of goods increases, the variable cost increases alongside. But, if the bakery currently operates at 50% capacity utilization, it can put more cookies into the same machinery and then the fixed costs would remain the same. This would lead to reduction in total cost per unit whereas the selling price remains the same. The increase in margins as a result of reduction in per unit cost, due to increased capacity utilization or economies of scale, is known as operating leverage.

Now let’s get a bit more technical about this. Lets us start by understanding the difference between a trading and a manufacturing company. A trading company will buy ready-made goods at lower cost and will sell it further at higher costs. Here, the P&L statement will be quite simple:-

In a manufacturing company, there will be many more expenses like plant and machinery expenditure, depreciation on plant and machinery, labour costs, etc. For simplicity, let’s just consider depreciation in our example as it is a major expense. Its P&L will look like this:-

So when we classify these expenses, they can be segregated into 2 broad categories:-

a. Variable costs – It includes all those expenses which vary directly with respect to the revenue. For example, the purchases and raw materials consumed vary directly with changes in revenue because we need more raw materials/ need to purchase more goods to sell more and increase revenue.

b. Fixed costs – Fixed costs are costs that are not dependant on the business operations. For example, depreciation and rent. We have to pay rent and depreciate assets whether we use it or not. Though, in depreciation, the expense may vary in case of double and triple shifts. But it is not directly proportional because for 1 shift, depreciation is say “X”, then for double shift it won’t be “2x” and instead be just “1.5x”.

Hence, if the revenue of a trading business doubles, the cost of purchases will also double (assuming buying price and selling price have increased in the same proportion) and the margins in the end would remain stable. Let us take an example for better clarity of the concept.

CASE I: TRADING BUSINESS

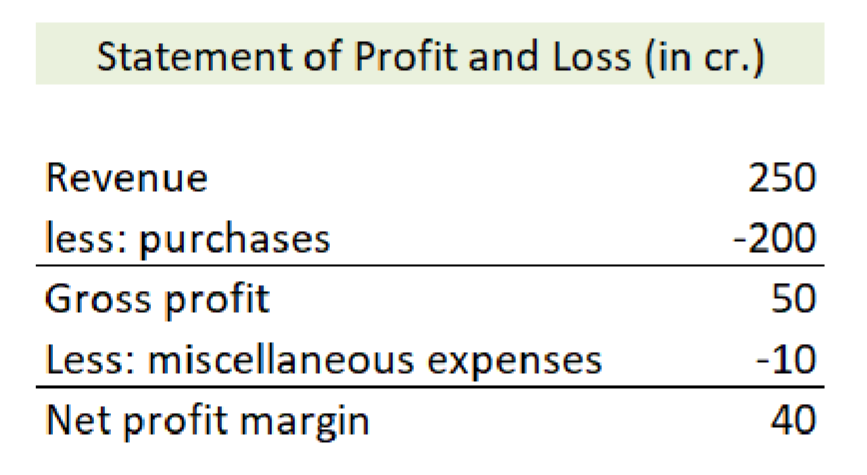

Say, for example, a company ABC Ltd. is into the business of trading clothes. It purchases clothes worth 100crores in the first year and sold it for 125crores. There were miscellaneous expenses amounting to 10crores. So its statement of Profit and Loss would look like this:-

Here, gross profit margin is 20% (=25/125) and the net profit margin is 12% (=15/125).

Suppose, next year, the revenue doubles. This means the purchases would also have to double (unless the company has pricing power and is able to increase prices, but that is not the case in this example). The P&L would then look like this:-

The gross profit margin here is same as before i.e. 20%. The Net profit margin has increase slightly to 16% (this increase wouldn’t be there if the fixed cost of miscellaneous expense won’t exist). In simple terms, an increase of 100% in revenue leads to an increase of 16% in net profit.

CASE II: MANUFACTURING BUSINESS

In a manufacturing company, if the revenue doubles, the cost of raw materials would double but depreciation would stay stable, thereby resulting in a higher net profit margin. Let us understand this through another example.

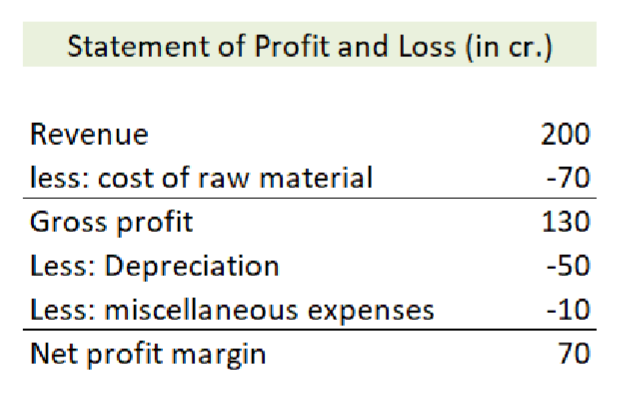

Say, for example, a company XYZ Ltd. is into the business of manufacturing clothes. It purchases raw materials worth 70crores in the first year and sold manufactured clothes worth 200crores. There was depreciation worth 40crores and miscellaneous expenses amounting to 10crores. So its statement of Profit and Loss would look like this:-

Here, gross profit margin is 65% (=130/200) and net profit margin is 35% (=70/200).

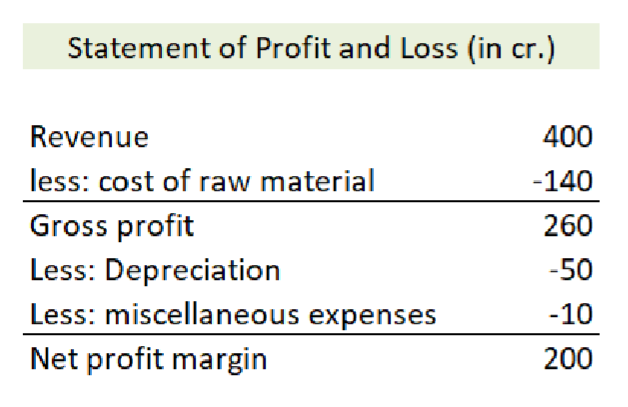

Suppose, the revenue doubles next year. This will also cause the raw material cost to double. But the depreciation expense stays the same. The P&L for next year would look like this:-

Here, the gross profit margin is 65% (=260/400) and the net profit margin is 50% (=200/400). In simple terms, a 100% increase in revenue will increase net profit by 50%.

Comparing both these companies, we can see that the trading company which had higher variable costs, has lower operating leverage as compared to the manufacturing company with lower variable cost. Hence, we can conclude that a company with higher fixed cost can have operating leverage.

In the stock markets, operating leverage is a common characteristic of most multi-bagger stocks. For example, if a company has net profit of 10000crores and the market gives it a multiple of 10. When the company will benefit from the existing operating leverage, the increase in its revenue will largely get transferred into its net profit. And because of this, the net profits will spike. This would in turn lead to a spike in its market capitalisation. A few sectors which have inherent operating leverage are those with high capital expenditure requirements like hospital industry, amusement parks, airlines, etc.

In a nutshell, we can say that operating margin exists in a company if it has:-

i. Higher fixed costs ii. Lower capacity utilization

Amazing writing 👍

LikeLike

Didn’t know operating leverage in this much depth. Thanks for writing this 😃

LikeLike

Hey there, you have an amazing way of explaining things. The simplicity you bring in is wonderful!

LikeLike

Amazing writing. I’d love to collaborate with you for a post. Please let me know if you are interested?

LikeLike

Loved this article

It is detailed and well written.

Keep up the good work 👍

LikeLike

Hi guys! Just wanted to drop you a line to say that I really enjoyed reading your article! Great perspective. Have an awesome day!

LikeLiked by 1 person

Good Afternoon, I am a PR assistant and I am reaching out to offer you to publish some of our product reviews and guides on your website. We are working hard to grow our brand so we thought that publishing articles on your website. When I was reviewing your website, I thought that your visitors would enjoy reading articles on these subjects. In writing up our articles, we have chosen the top selling products from our store! All articles are 100% unique and have not been published elsewhere 🙂 Please let me know if you would like to collaborate.

Likewise, if you have some interesting articles, do hit us up on our Facebook page and we could publish those for you 🙂

Thanks for your time and have a fab day! Kind regards, April Lord

LikeLike

I don’t know where you find your topics, but great topic !

I have spent a while reading on this. Thanks for writing this.

LikeLiked by 1 person